INTRODUCTION

Sterling Order Management System (OMS) allows users to configure financial attributes to manage the financial aspects of sales orders and return orders. The financial attributes will help us maintain the order price integration OMS and order capture channel. This is applicable for sales, return orders, and transfer orders.

CHARGES AND TAXES

The charges and discounts (promotions) will be calculated based on the business requirement. The configured charges and taxes in financial attributes will be added either in header level or line level while creating an order.

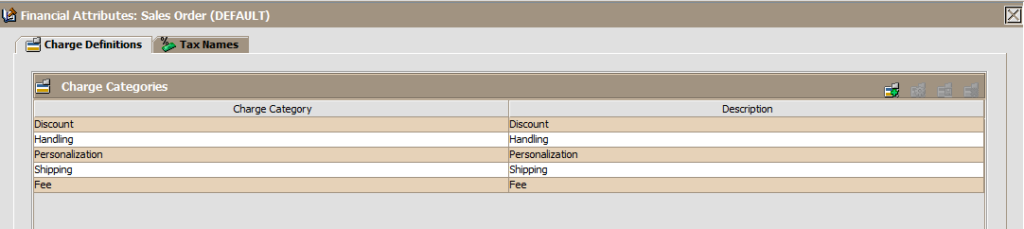

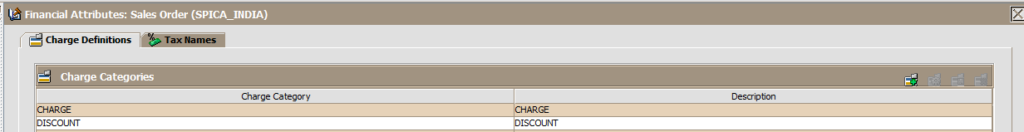

FINANCIAL ATTRIBUTES FOR SALES ORDER

CONFIGURATION

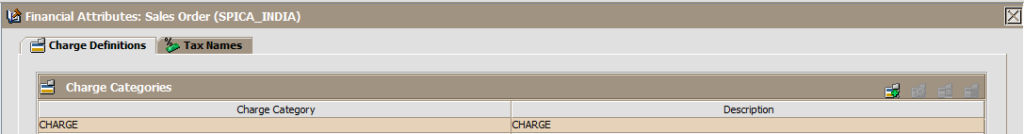

Distributed Order Management (DOM) à Document Specific à Sales Order (Document Type) à Financial à Financial Attributes

The above charges are the default charges which can be access by all enterprises.

CHARGE CREATION

The charge categories be added in either order header or line level.

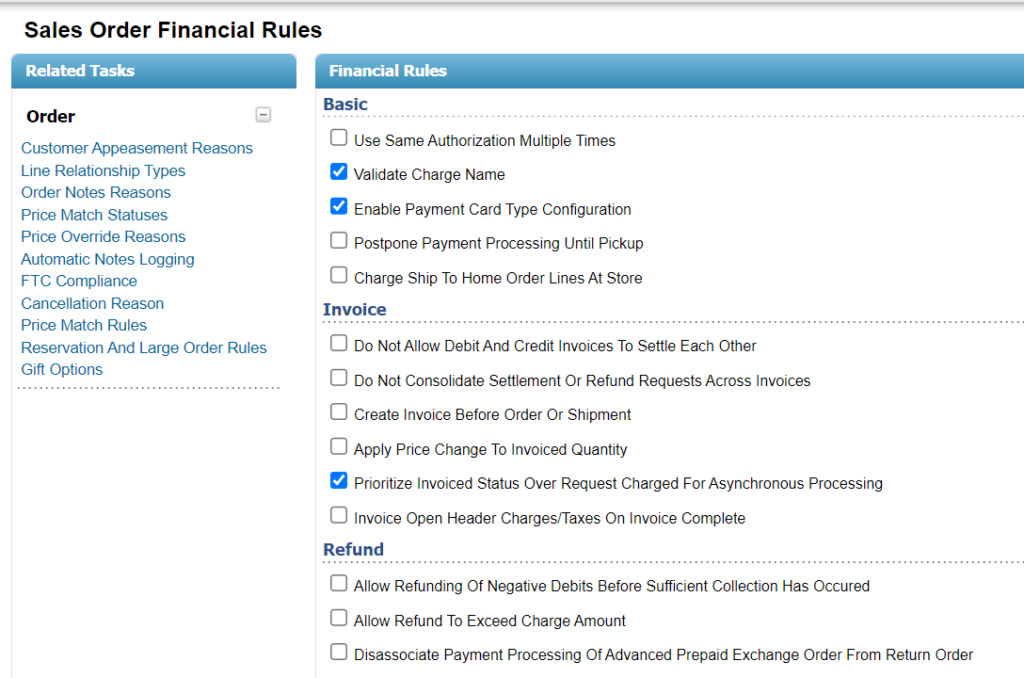

CHARGE VALIDATION

Go To SBC -> Switch to Enterprise level -> System Setup -> Order -> Financial Rules -> Enable ‘Validate Charge Name’ Option.

This charge name can be used or unused based on the Validate Charge Name rule in additional payment rules.

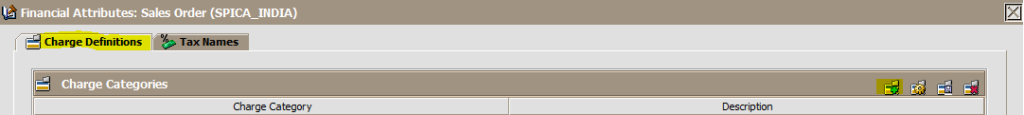

CHARGES(ENTERPRISE LEVEL)

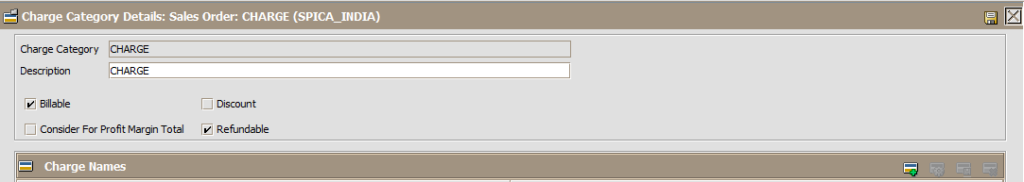

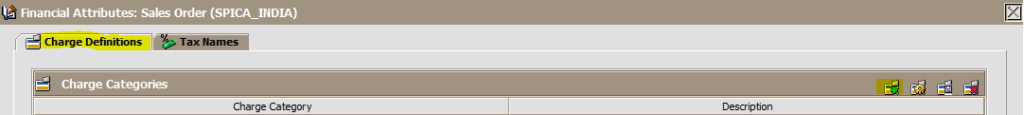

1. Choose the Charge Definitions tab.

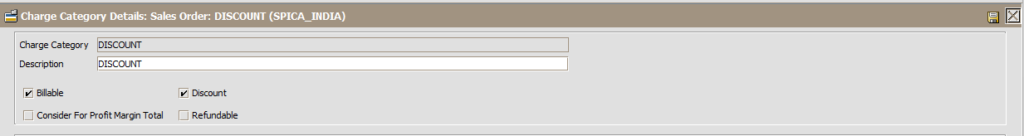

2. Create a new Charge Category. Provide the details in description and save it.

| Billable | If charge is billable (Non-Billable charges are not calculated in order total) |

| Discount | If charge is a discount |

| Consider for profit margin total | If charge is used for profit calculation |

| Refundable | If the charge is refundable when cancellation/ return is placed against the sales order. |

CREATE CHARGE NAME TO CHARGE CATEGORY

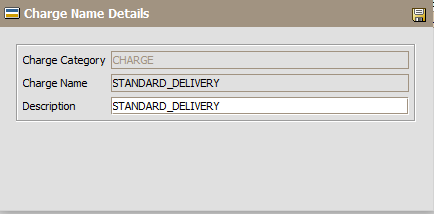

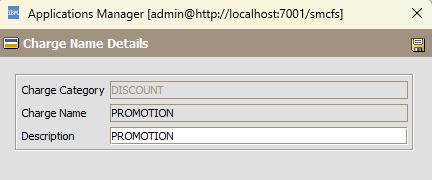

1. Select the charge category which you created.

2. Create new charge name. Provide the details in description and save it.

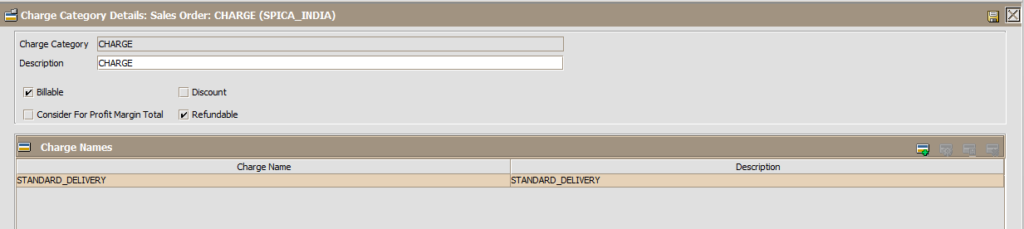

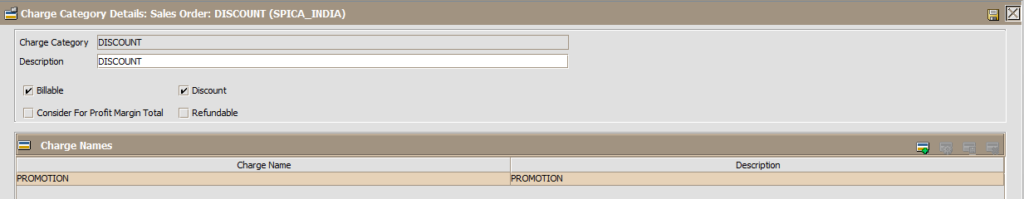

3. Verify the created charge name in charge category tab.

DISCOUNT(ENTERPRISE LEVEL)

1. Choose the Charge Definitions tab.

2. Create a new Charge Category. Provide the details in description and save it.

CREATE CHARGE NAME TO CHARGE CATEGORY

1. Select the charge category which you created.

2. Create new charge name. Provide the details in description and save it.

3. Verify the created charge name in charge category tab.

TAX CREATION

The Tax name can be used either in header level or in line level. We can access multiple taxes for single order.

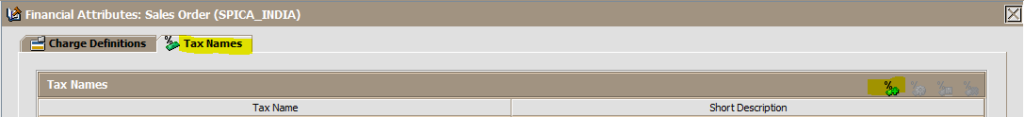

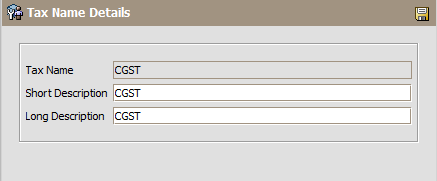

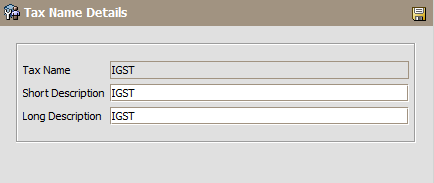

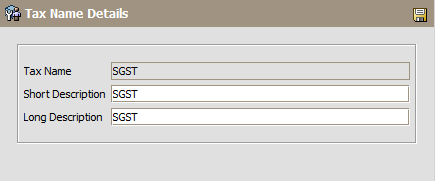

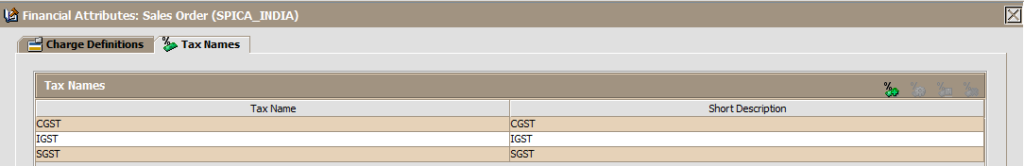

CREATING A TAX NAME (ENTERPRISE LEVEL)

1. Choose the Tax Names tab in Financial Attributes.

2. Create a tax name.

3. Verify the created Tax details in Tax Name window

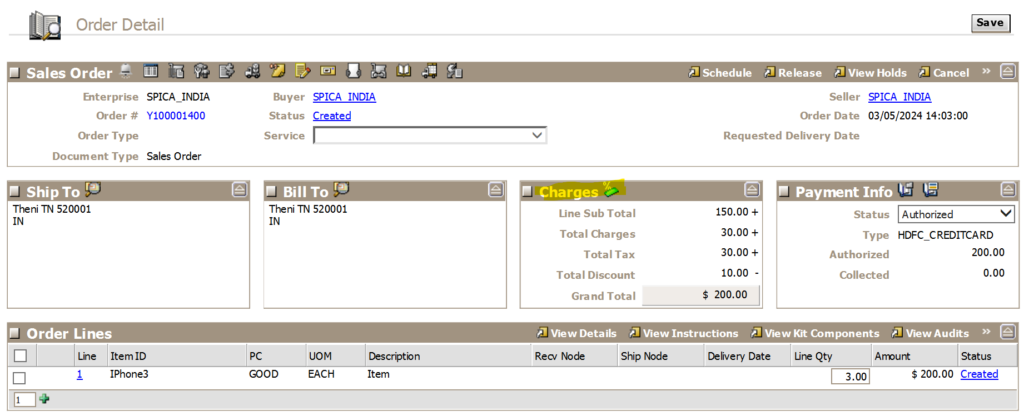

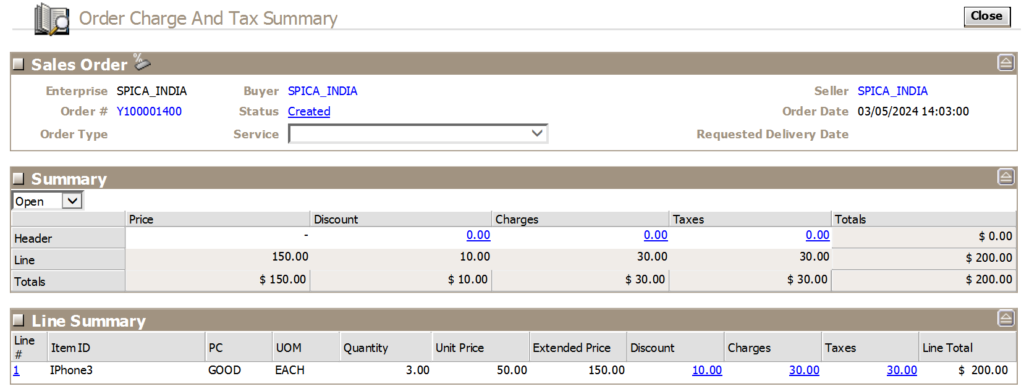

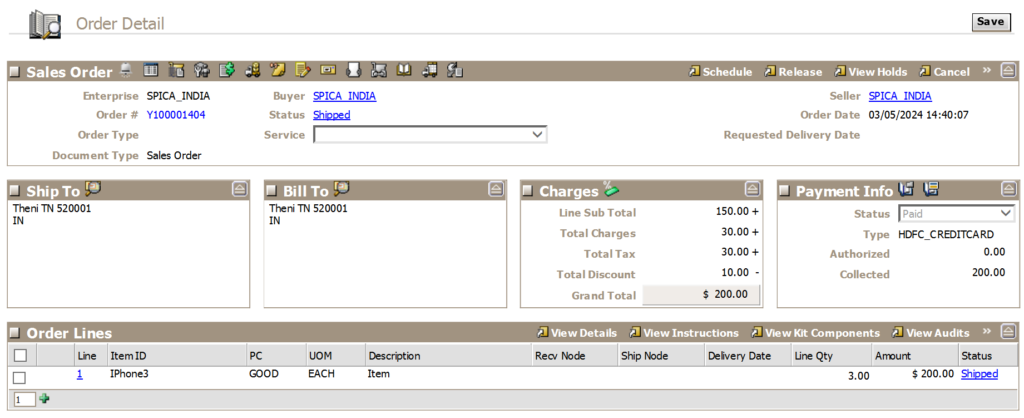

SALES ORDER FLOW FOR FINANCIAL ATTRIBUTES

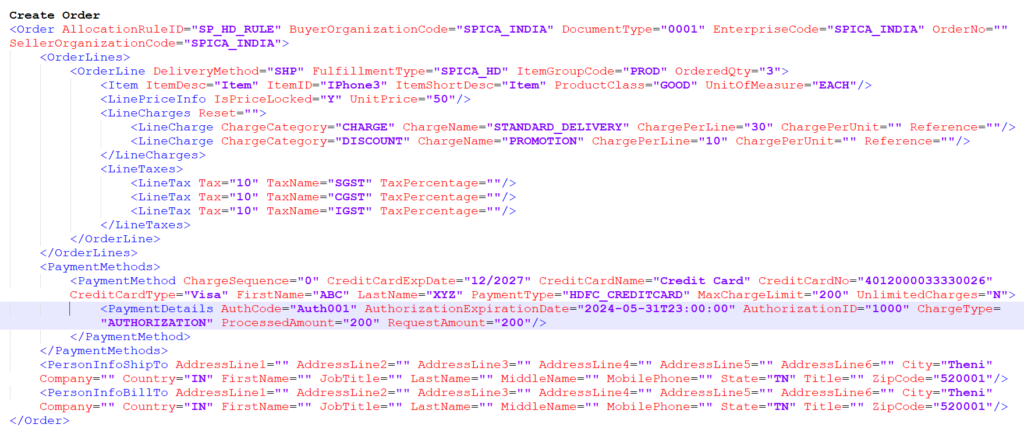

Create an order with Payment Details including Charges and Taxes.

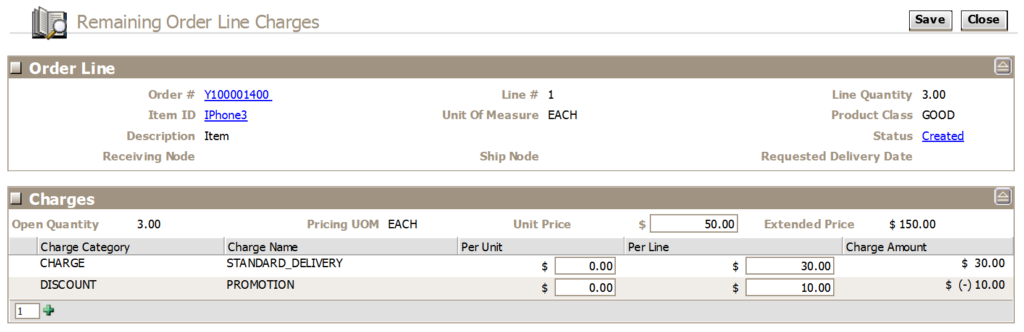

Charge Details

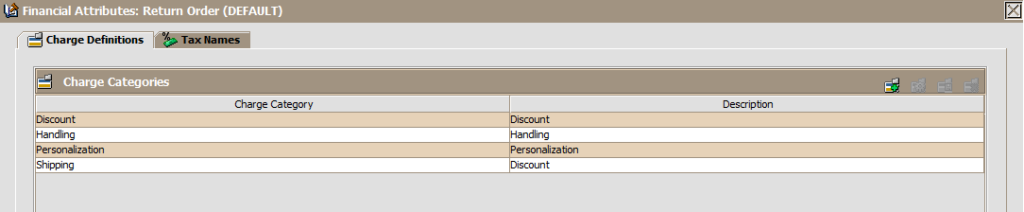

FINANCIAL ATTRIBUTES FOR RETURN ORDER

CONFIGURATION

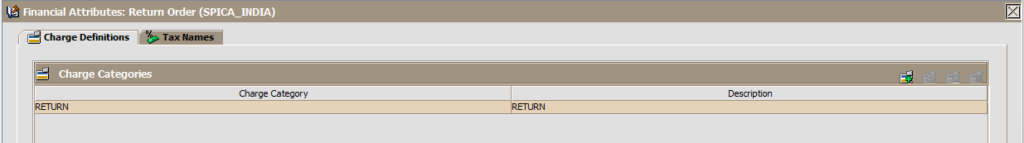

Reverse Logistics (RL) à Document Specific (Return Order) à Financials à Financial Attributes

The above charges are the default charges which can be access by all enterprises.

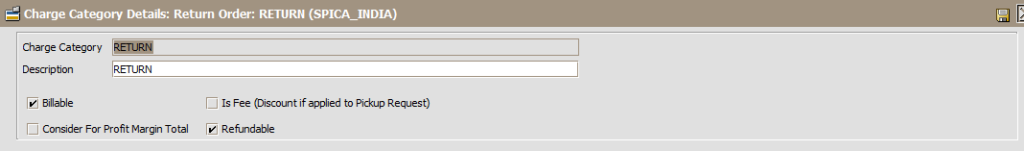

CREATE CHARGE CATEGORY (ENTERPRISE LEVEL)

1. Choose the Charge Definitions tab.

2. Create a new Charge Category. Provide the details in description and save it.

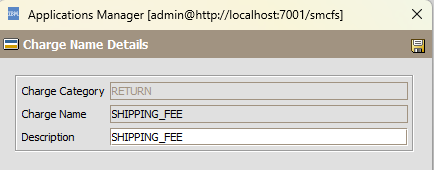

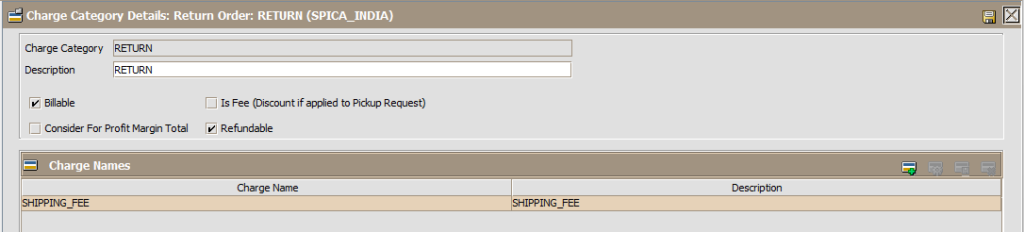

CREATE CHARGE NAME TO CHARGE CATEGORY

1. Select the charge category which you created.

2. Create new charge name. Provide the details in description and save it.

3. Verify the created charge name in charge category tab.

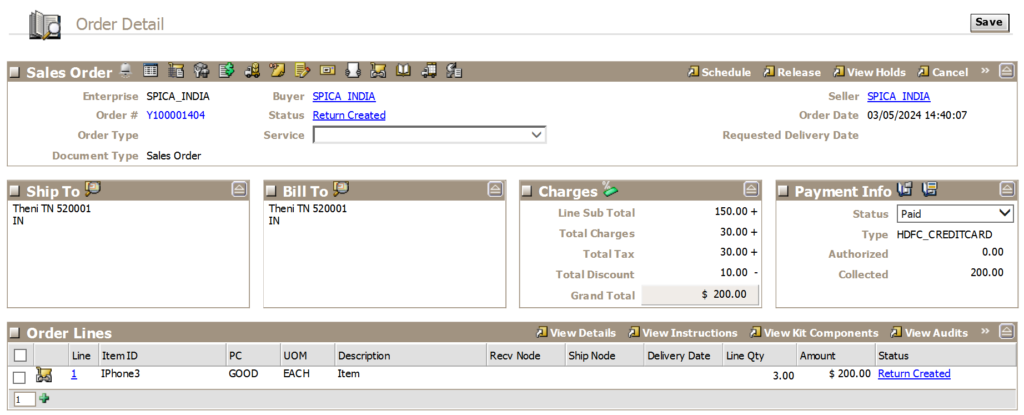

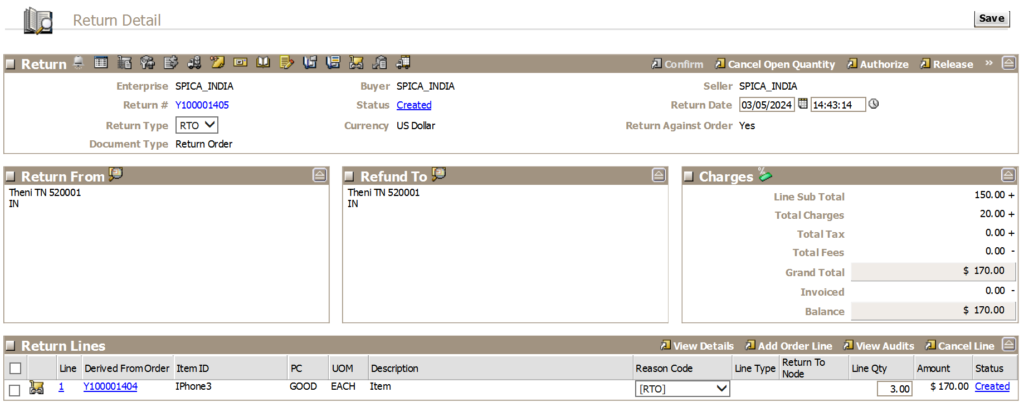

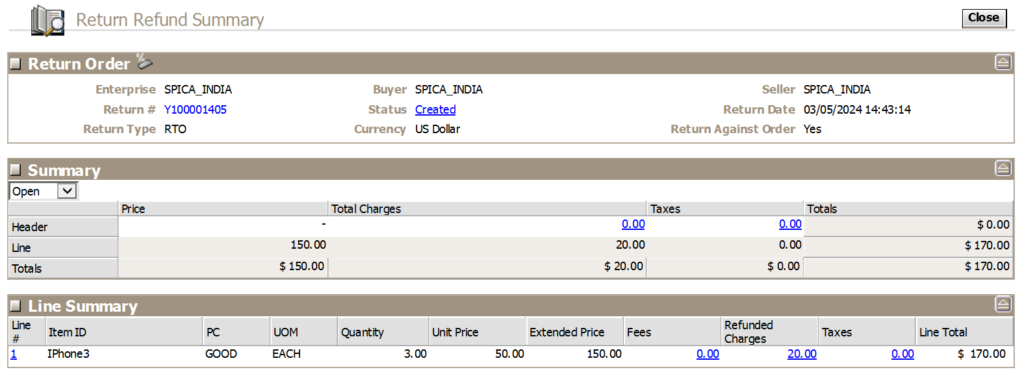

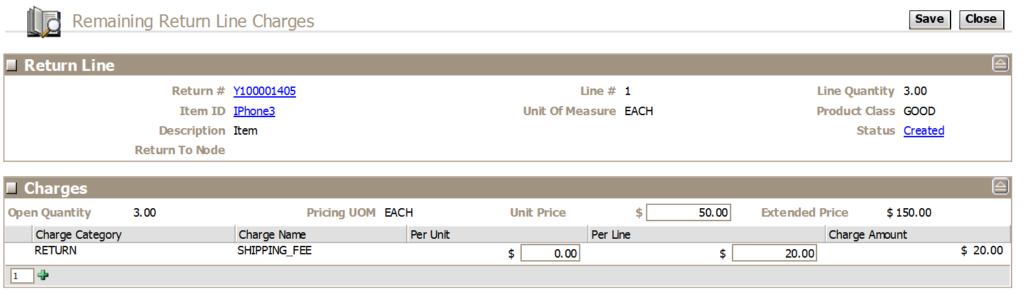

RETURN ORDER FLOW FOR FINANCIAL ATTRIBUTES

Create a Return Order for the above created sales order.

Return Order

Charge Details

#LetsTalkOMS #SpicaTech

In Return Order how is this Shipping Fee of 20$ populated ? It’s not present anywhere in the Sales Order right ?

Thanks for pointing out. The Shipping Fee is the same amount as delivery charge on the forward flow. The name is changed to shipping fee instead of delivery charge to give a better understanding of charge. Eventually its need to be return shipping fee. Cheers!